The DEBIT Card Pin:

1. The cardholder shall indemnify /disclose to any person of the personal identification number (pin) at any point of time and under any circumstances whether, voluntarily or otherwise. The cardholder shall not keep any written records of his pin in any place or manner which may enable a third party to use the Debit cum ATM Card.

2. Changing of pin, revision of card limit, change of host branch or replacement of card, etc. shall not be construed as commencement of a new contract.

Loss of DEBIT Card:

1. The card holder should immediately notify the branch from where he/she has obtained the card if the card is lost / stolen. The cardholder should change the pin immediately it is accidentally divulged.

2. Any financial loss arising out of unauthorized use of the card till such time the bank records the notice of loss of card will be to the card holder’s account.

3. The cardholders shall intimate, the loss of the Debit cum ATM Card to bank /branch/phone number +91 9586644644 and also to the branch where he/she is main training the account by way of a written communication during working hours. On receipt of the lost card information from the customer, head office will hot list the card.

However, bank shall not liable for the transactions happened using the lost card, prior to the hot listing of the card.

ATM usages:

The card can be used at the ATM location with the help of the confidential pin. All transactions conducted with use of the pin will be the cardholder is responsibility. The cardholder agrees that he will be allowed to withdraw only a certain amount of cash per transaction per day as determined by bank irrespective of the credit balance in the account(s).This amount will be announced from time to time. Any attempt to violate this limit may lead to withdrawing of his card facility. When the cardholder completes a transaction through an ATM he can opt to receive a printed transaction record i.e. the transaction slip/ATM receipt. The amount of available fund is shown on this ATM receipt when he cardholder uses his card. The cardholder is advised to retain the record of transaction generated by the ATM with him. Cardholder agrees not to attempt to withdraw using the cards unless sufficient funds are available in the account. The onus of ensuring adequate account balances is entirely on the cardholder.

Merchant Location usages:

Bank Debit Cards affiliated to NFS (NPCI) are accepted at all Merchant Establishments displaying Rupay Logo. The Merchant should have an electronic (Point- of- sale) swipe terminal. Usage is permitted up to Rs. 100,000 per day at Merchant locations say, Restaurants, Hospitals, Departmental Stores, Textile outlets; Jewelries etc. present your debit card for payment of the purchase amount. The merchant will swipe the card in the point-of-sale machine for authorization. You will be presented the PIN pad, Key in your PIN at the merchant establishment. After a successful authorization, a charge slip is generated from the POS machine. Ensure for correctness of the amount and sign the charge slip exactly as appearing on the reverse of your card. Collect back your card and your copy of the charge slip. Please retain the charge slip copy till you verify the amount as appearing in your bank statement of account. There are certain exceptional cases where you may be billed extra service charges while making use of your Card with MEs such as Petrol Bunks, Railways, etc. Only if you agree to bear extra charges, you should proceed with the transaction. Such service charges together with the charge slip amount will be debited to your operative account. Please note that since signature verification is essential for debit card transactions you need to be physically present along with your card at the time of purchase. Debit card can be used on the Internet (e-commerce transaction) provided the card is registered with Verified by NPCI Rupay PaySecure.

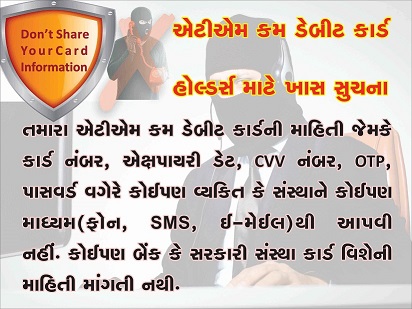

SAFETY TIPS DEBIT CUM ATM CARD.

OTHER INFORMATION FOR CUSTOMER AWARENESS

VARA LOST A/C NUMBER to 91335 74000

|

Change your passwords (don't use your Birthday,Mobile No,Vehicle No,House No,Area No),Debit Card PINs frequently. |

|

Do not share your Mobile/Net banking login credentials with anyone. |

|

Always use licensed Version anti-virus software. |

|

Always type your URL to access any online portal (Like.https://). |

|

Do not click on suspicious links received through e-mail or message. |

|

Always use the latest browser version. |

|

Always scan your computer & external devices through licensed anti-virus. |

|

Do not store passwords in your Mobile/Computer/Laptops. |

Do not use public computers/Laptops - free Wi-Fi to login. |

|

|

Check your account statement at regularly. |

Disconnect the internet connection when not in use. |

|

|

Check authenticity of the applications before downloading them. |

|

Always use a newer version of OS. |

|

Make sure that firewall is enabled. |

|

Be aware of Phishing and Vishing attacks. |

|

Check your bank’s SMS messages in a timely manner and verify your transaction records.Inform your bank immediately in case of any suspicious situations. |

|

Varachha Bank executives/officers/representatives never call/SMS/email you to ask your personal information, passwords, debit card details, OTP, etc. |