| Eligibility of borrower |

|

| Proof of Business and Financial data of firm / Company |

|

|

Proof of identity [ All individuals ] |

|

|

Proof of Address [Business premises & residence] |

|

|

Proof of income |

|

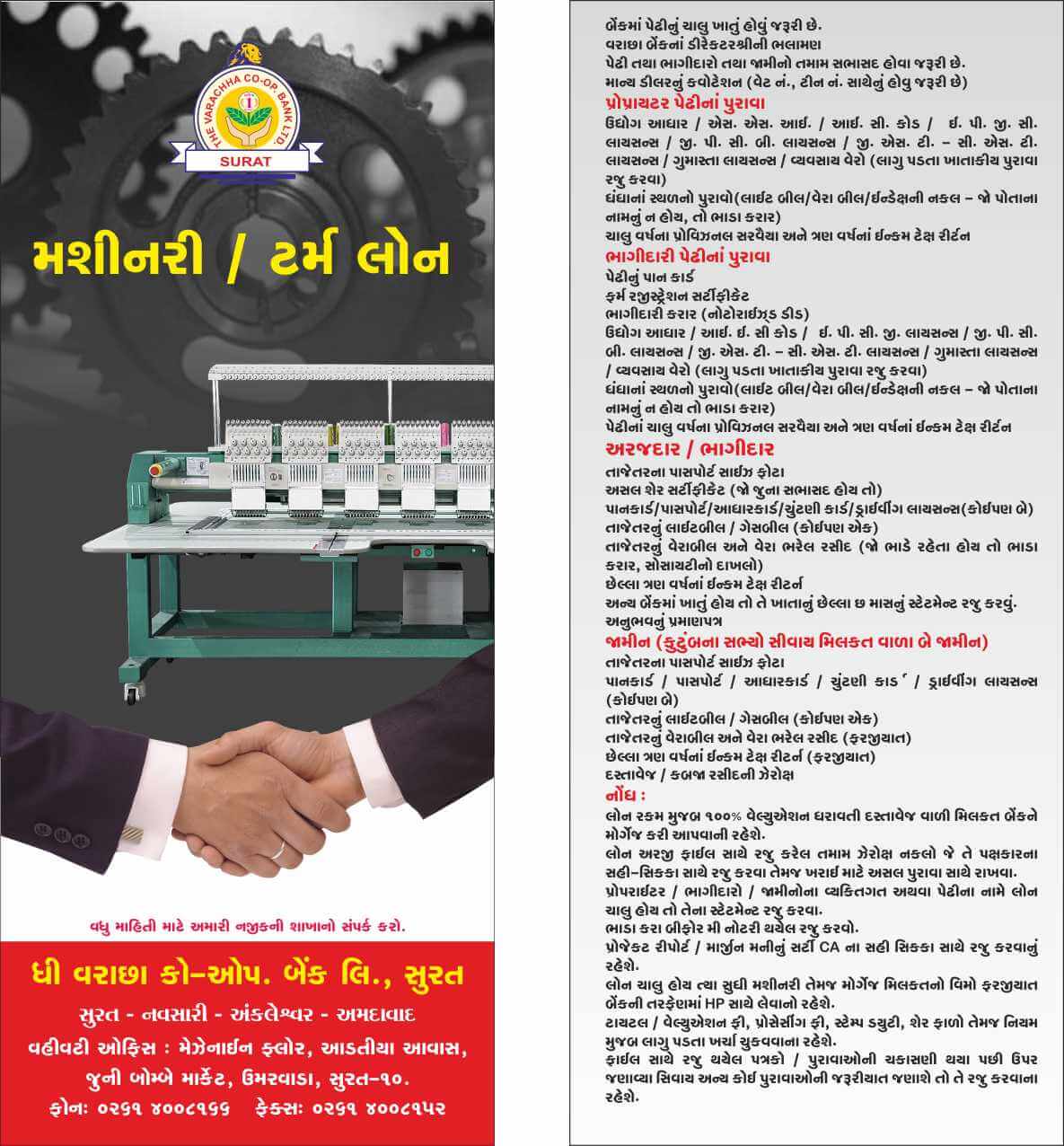

| Purpose of Loan |

|

| Quantum of finance |

|

| Share Linkage |

|

| Repayment period |

|

| Rate of Interest |

9.00% p. a. |

| Security | Prime:

Collateral: Up to 100 % Collateral security by way of equitable / simple mortgage of title cleared property of the borrower / guarantor should be obtained. OR 70% FD against loan amount in applicant firm's name to be pledged. OR 60% FD against loan amount in applicant firm’s name to be pledged as per under noted conditions :- [ A ] Maximum sanction amount should not exceed rupees one crore under this parameter. [ B ] If an existing one year old regular installment repaying borrower needs further fresh loan in the same name / firm. [ C ] If an applicant represents a guarantor who is an existing one year old C/C OR Machinery loan holder of our Bank with all other regularities and have mortgaged his own property with the Bank. [ D ] If an applicant surrenders original Kabja Karar of his own or guarantor’s property having market value equivalent to the loan amount by way of PA in favour of the Bank. OR 50% FD against loan amount in applicant firm’s name to be pledged as per under noted conditions :-

[ A ] Conditions mentioned above under A to D will be applicable. [ B ] Moratorium period will not be allowed. [ C ] Interest will be charged 0.50% more than the regular rate. |